tax shield formula cpa

In general a tax shield is anything that reduces the taxable income for personal taxation or corporate taxation. This companys tax savings is equivalent to the interest payment multiplied by the tax rate.

Straight Line Depreciation Formula Guide To Calculate Depreciation

CPA CFE REFERENCE SCHEDULE 2018 1.

. It is important to have the depreciation numbers along with the income tax rate of the entity being calculated. Federal income tax rates. Tax Shield Value of Tax Deductible - Expense x Tax Rate Example If a business has 1000 in mortgage interest and its tax rate.

CCA Tax Shield Notes - Developing CCA Tax Shield Formula 1000000 asset 5 declining balance CCA rate 35 tax rate 10 discount rate Year UCC CCA. As such the shield is 8000000 x 10 x 35 280000. The resulting figure is the tax savings due to depreciation.

Google company has an annual depreciation of 10000 and the rate of tax is set at 20 the tax savings for the period is 2000. For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m. Interest 8000 ie 2000004 Tax Shield 8000 45000 30 15900.

For more resources check out our business templates library to download numerous free Excel modeling PowerPoint presentation and Word document templates. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of Total Tax Shield from CCA for a New Asset Notation for above formula. 2017 2018 Basic personal amount 11635 11809.

Calculation of the tax shield follows a simplified formula as shown below. This is very valuable to companies. With the straight-line method the tax shield will turn out to be lower but it is still a way to cut down your businesss tax bill.

A tax shield is the deliberate use of taxable expenses to offset taxable income. The tax rate for the company is 30. The intent of a tax shield is to defer or eliminate a tax liability.

Attribution Non-Commercial BY-NC Available Formats. The formula for this calculation can be presented as follows. Present value PV tax shield formula.

The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. CPA Canada s Reference Schedule of allowances and tax rates used in their Core evaluations Keywords. Calculate the Depreciation Tax Shield from the following formula.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable. Interest Tax Shield Interest Expense Tax Rate. For instance we are looking at Bear company that has a 35 tax rate.

C net initial investment. C net initial investment T corporate tax rate. Tax Shield Deduction x Tax Rate.

Personal tax credits are a maximum of 15 of the following amounts. This is usually the deduction multiplied by the tax rate. Depreciation is considered a tax shield because depreciation expense reduces the companys taxable income.

It is because 400 has already been saved or there is 400 less cash flow due to the tax shield. All in One Financial Analyst Bundle 250 Courses 40 Projects 250 Online Courses. Generally Accepted Accounting Principles.

Once these numbers are found you multiply depreciation by the income tax rate. Companies using a method of accelerated depreciation are able to save more money on tax payments due to the higher amount of possible tax shield. Interest rates for taxable benefits.

This can lower the effective tax rate of a business or individual which is especially important when their reported income is quite high. Flag for inappropriate content. CPA COMMON FINAL EXAMINATION REFERENCE SCHEDULE 1.

Tax Shield For Individuals. Save Save CCA Tax Shield Formula For Later. The effect of a tax shield can be determined using a formula.

The intuition here is that the company has an 800000 reduction in taxable income since the interest expense is deductible. There are two simple steps to calculate the Depreciation Tax Shield of a company or individual. But if we avail the option to convert the bond the net value of lost tax shield is 2000 1 20 1600.

This is equivalent to the 800000 interest expense multiplied by 35. Now lets look at the impact that having debt has on the organizations Income statement which is going to take the form of the interest tax shield. 100 1 100 found this document useful 1 vote 33K views 1 page.

How to Calculate Tax Shield. Depreciation Applicable Tax Rate. The tax shield computation is represented by the formula above.

One of the. Download as PDF TXT or read online from Scribd. So adding back 1600 will add back interest equivalent to 2000.

Capital cost allowance rates. The tax shield strategy can be used to increase the value. Else this figure would be less by 2400 800030 tax rate as only depreciation would.

So the total tax shied or tax savings available to the company will be 15900 if it purchases the asset through a financing arrangement. Final Exam Solutions Summer 2009. When a company purchased a tangible asset they are able to depreciation the cost of the asset over the useful life.

PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation for above formula. Tax Shield Sum of Tax-Deductible Expenses Tax rate. The product of the depreciation and income tax numbers is.

Tax Shield Formula Step By Step Calculation With Examples

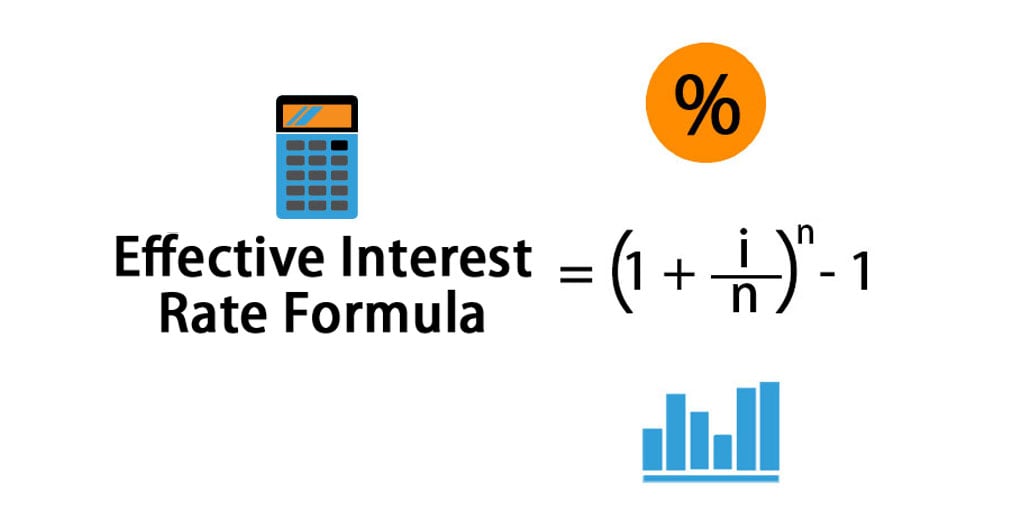

Effective Interest Rate Formula Calculator With Excel Template

Times Interest Earned Tie Ratio Formula And Calculator

Cash Flow After Deprecition And Tax 2 Depreciation Tax Shield Youtube

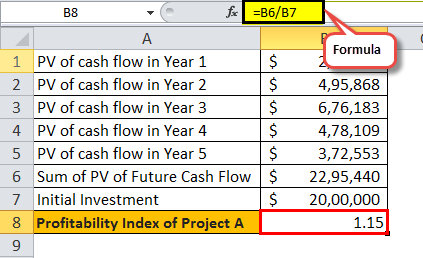

Profitability Index Formula Calculate Profitability Index Examples

Tax Shield Formula Step By Step Calculation With Examples

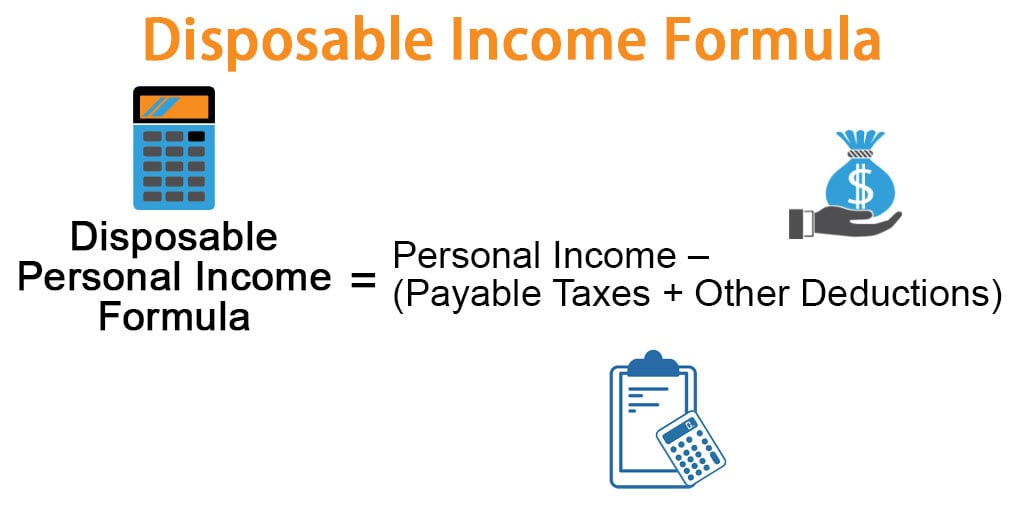

Disposable Income Formula Examples With Excel Template

Current Yield Meaning Importance Formula And More Finance Investing Learn Accounting Accounting And Finance

Formula Jpg Pv Of Cca Tax Shield Formula Pv Tax Shield On Cca Cch X 0 S X 1 D K L K D K 1 17c L Where C Cost Of Asset D

Tax Shield Formula Step By Step Calculation With Examples

Capital Cost Allowance Canada Youtube

What Is A Depreciation Tax Shield Universal Cpa Review

Cca Tax Shield Formula Pdf Public Finance Taxation

Times Interest Earned Tie Ratio Formula And Calculator

/dotdash_Final_EBITDA_To_Interest_Coverage_Ratio_Dec_2020-012-3a127232967d435d93bda56dd6b7211f.jpg)

Ebitda To Interest Coverage Ratio Definition

Tax Shield Formula Step By Step Calculation With Examples

Wacc Diagram Explaining What It Is Cost Of Capital Financial Management Charts And Graphs

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-369e05314df242c3a81b8ac8ef135c52.jpg)