pa inheritance tax exemption amount

Benefi t plans that are exempt for Federal Estate Tax purposes are exempt from the Pennsylvania Inheritance Tax. The family exemption may be claimed by a spouse of a decedent who died as a resident of Pennsylvania.

What You Should Know About Sales And Use Tax Exemption Certificates Marcum Llp Accountants And Advisors

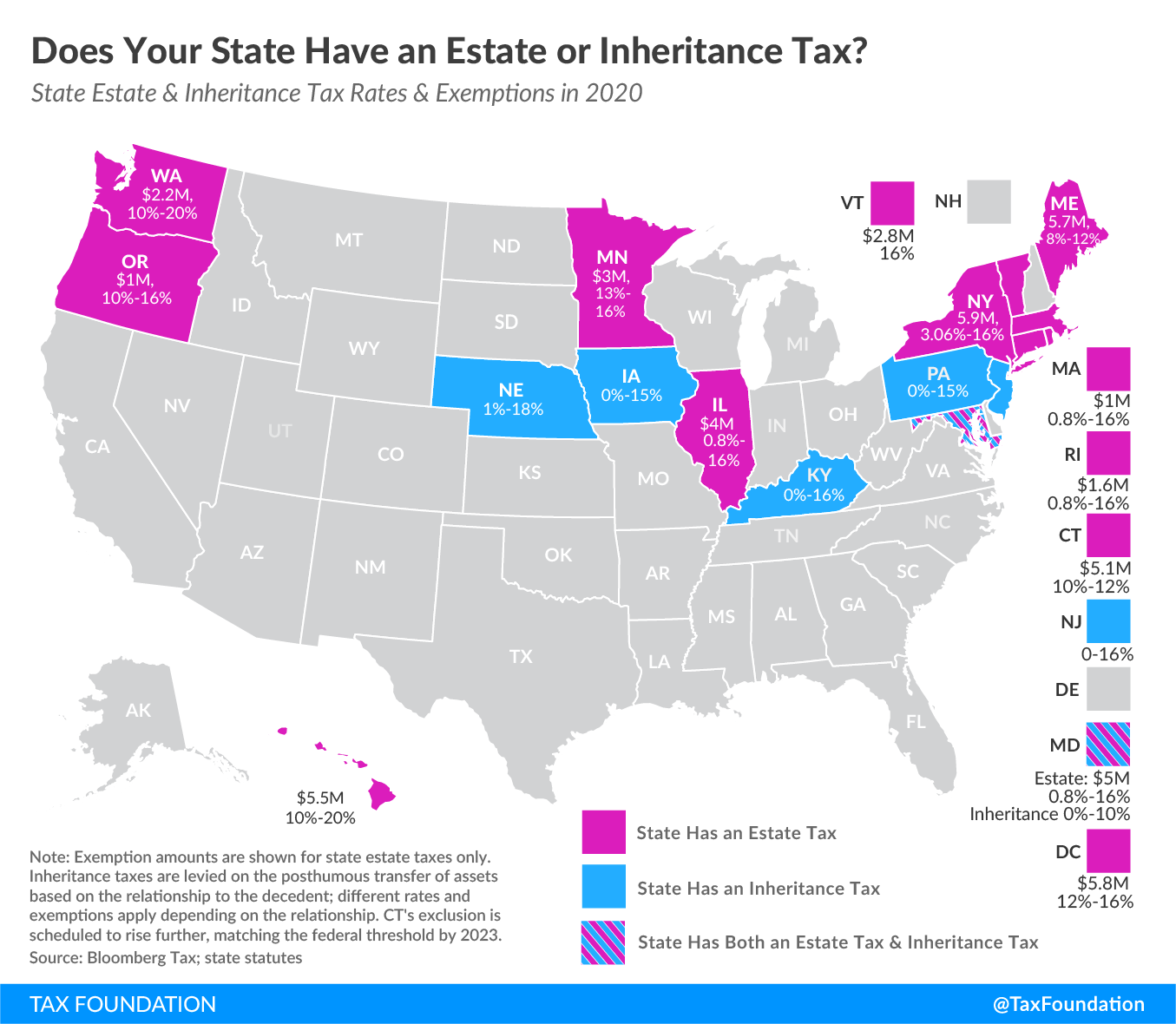

While federal estate taxes and state-level estate or inheritance taxes may apply to estates that exceed the applicable thresholds for example in 2021 the federal estate tax.

. 12 for asset transfers to siblings. The tax on Pennsylvania inheritance is calculated according to the decedents age. The tax rate is.

A rate of six percent applied to assets that passed to so-called lineal descendants such as children grandchildren and. 15 for asset transfers to other heirs. Traditionally the Pennsylvania inheritance tax had two tax rates.

And to find the amount due the fair market values of all the decedents assets as of death are. It is a four-and-a-half percent tax for direct descendants and 12 for siblings. There is a federal estate tax that may apply and Pennsylvania does have an inheritance tax.

Since the federal exclusion was elimi-nated for estates of most. While the Pennsylvania inheritance tax can take a bite out of your estate it is rarely devastating. REV-720 -- Inheritance Tax General Information.

The 2021 tax year limit or the amount limit in 2022 after adjusting for inflation is 1206 million up from 117 million in 2021. Other Necessary Tax Filings. The federal gift tax has an exemption of 15000 per recipient per year for.

REV-714 -- Register of Wills Monthly Report. The Pennsylvania inheritance tax isnt the only applicable tax for the estates of decedents. Charities and the government generally are.

To exempt inheritanc ny other a e statute d the broth estors and oing and t r legal ado ame family was claime of Revenue the seven f agricultur any year e been paid ents death tatepaus mily. If the decedent dies before the tax can be paid the. If there is no spouse or if the spouse has forfeited hisher rights.

There are other federal and state tax requirements. Pennsylvania Inheritance Tax Safe Deposit Boxes. The estate tax is a tax on an individuals right to transfer property upon your death.

Method 1 to minimize or avoid PA inheritance tax. The surviving spouse does not pay a Pennsylvania inheritance tax. There is no limit to the.

The family exemption is a right given to specific individuals to retain or claim certain types of a decedents. What is the family exemption and how much can be claimed. The Pa tax inheritance tax rates are as follows.

Assets gifted more than 12 months prior to death are excluded from PA inheritance tax. REV-1197 -- Schedule AU. 45 for any asset transfers to lineal heirs or direct descendants.

In an attachment to the tax return. Lets say that when you die your leave your home and investments to your. Attorney fees incidental to litigation instituted by the beneficiaries for their benefit do not constitute a proper deduction.

If you have any questions about. Furthermore this exemption can be taken as a deduction on line 3 of Schedule H of the Pennsylvania Inheritance Tax Return Form REV-1500.

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How To Minimize Or Avoid Pennsylvania Inheritance Tax Retirement Planning

Estate Tax Exemptions 2020 Fafinski Mark Johnson P A

10 Ways To Be Tax Exempt Howstuffworks

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

South Carolina Estate Tax Everything You Need To Know Smartasset

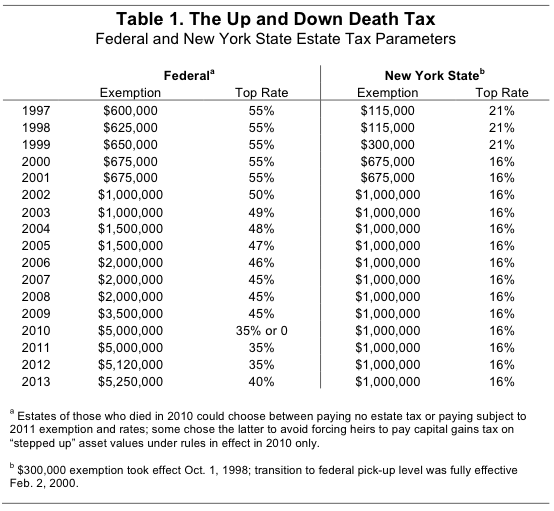

New York S Death Tax The Case For Killing It Empire Center For Public Policy

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Map State Sales Taxes And Clothing Exemptions Trip Planning Map Sales Tax

What Is A Homestead Exemption And How Does It Work Lendingtree

Don T Die In Nebraska How The County Inheritance Tax Works

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

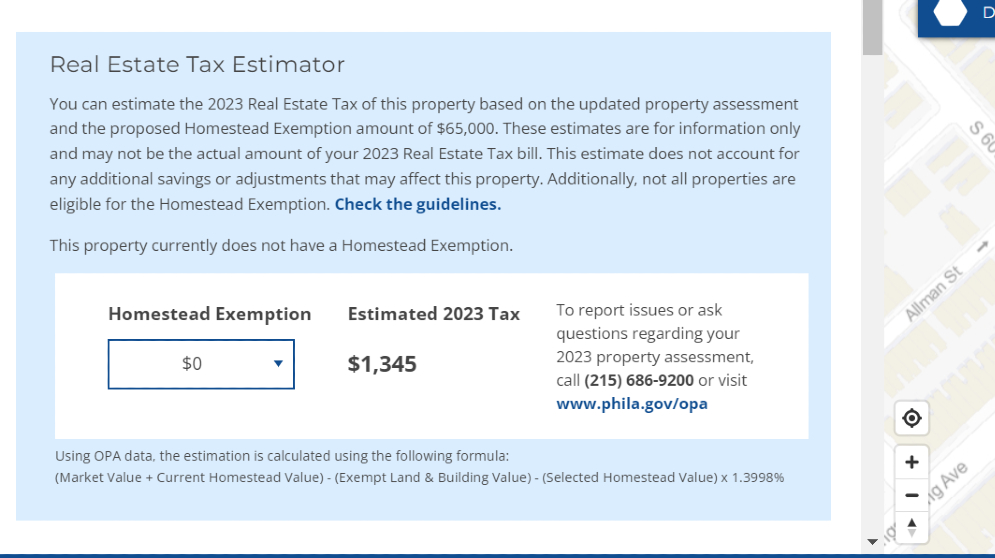

Estimate Your 2023 Property Tax Today Department Of Revenue City Of Philadelphia

New York S Death Tax The Case For Killing It Empire Center For Public Policy

Gift Tax Exemption Lifetime Gift Tax Exemption The American College Of Trust And Estate Counsel

Will The Lifetime Exemption Sunset On January 1 2026 Agency One

Inheritance Tax How Much Will Your Children Get Your Estate Tax Wealthfit